Dual Pricing / Cash Discount

Looking to eliminate your card processing fees?

Dual Pricing

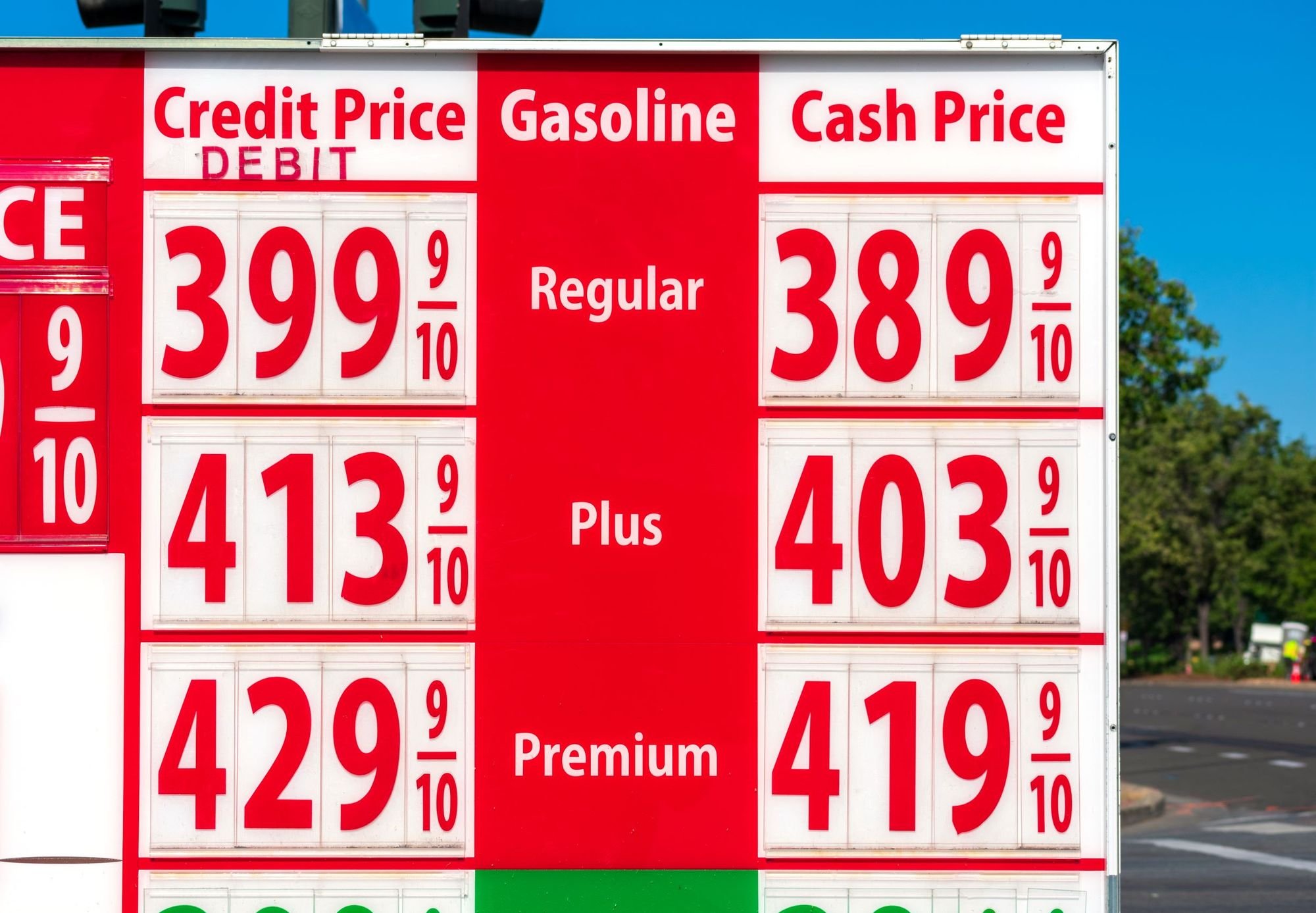

Dual Pricing is a program where businesses advertise two different prices on their products or services: a card price and a cash price. Most commonly seen at gas stations around the country, customers are given a high price per gallon when paying with a credit/debit card compared to paying with cash. In order to effectively implement Dual Pricing into your payment processing, credit card companies require businesses to follow a few compliance standards: advertise two different prices on each product or service, use the card price as the “official” sale price, don’t frame the card prices as a surcharge (regulated differently), and comply with the Payment Card industry Data Security Standards

Dual Pricing Rate

3% - 4%

*Rate depends on effective rate, monthly, volume, and credit card volume*

Cash Discount

Cash Discount refers to the incentive that a seller offers to its customers when paying for a transaction with cash. With this pricing program, a seller is reduces the total amount that a buyer owes by a certain percentage when they choose to pay with cash. In order to be in compliance with Visa standards, sellers using the Cash Discount program are required to post their products or services as the card price and offers a discount on that price when a customer pays in cash. Additionally, no extra fees should be added at the register or terminal, credit pricing are to be posted on the shelves and menus, and cash users are to receive a discount at the time of payment.

Cash Discount Rate

3% - 4%

*Rate depends on effective rate, monthly, volume, and credit card volume*